Insurance Call Center

Equip yourself with a modern insurance call center. Efficiently manage your inbound call volume, and provide a seamless experience for your customers when they contact you for specific assistance, information, or underwriting.

What is an insurance call center?

The insurance call center is an essential structure that has largely evolved in recent years. Indeed, call centers are becoming contact centers with the objective of offering customers a personalized and seamless experience, insofar as all the communication channels favored by customers are invested by the company. These platforms enable insurance professionals to manage their customer relationships and play a key role in claims management, underwriting, technical assistance and customer service.

What are the infrastructural needs to set up an insurance call center?

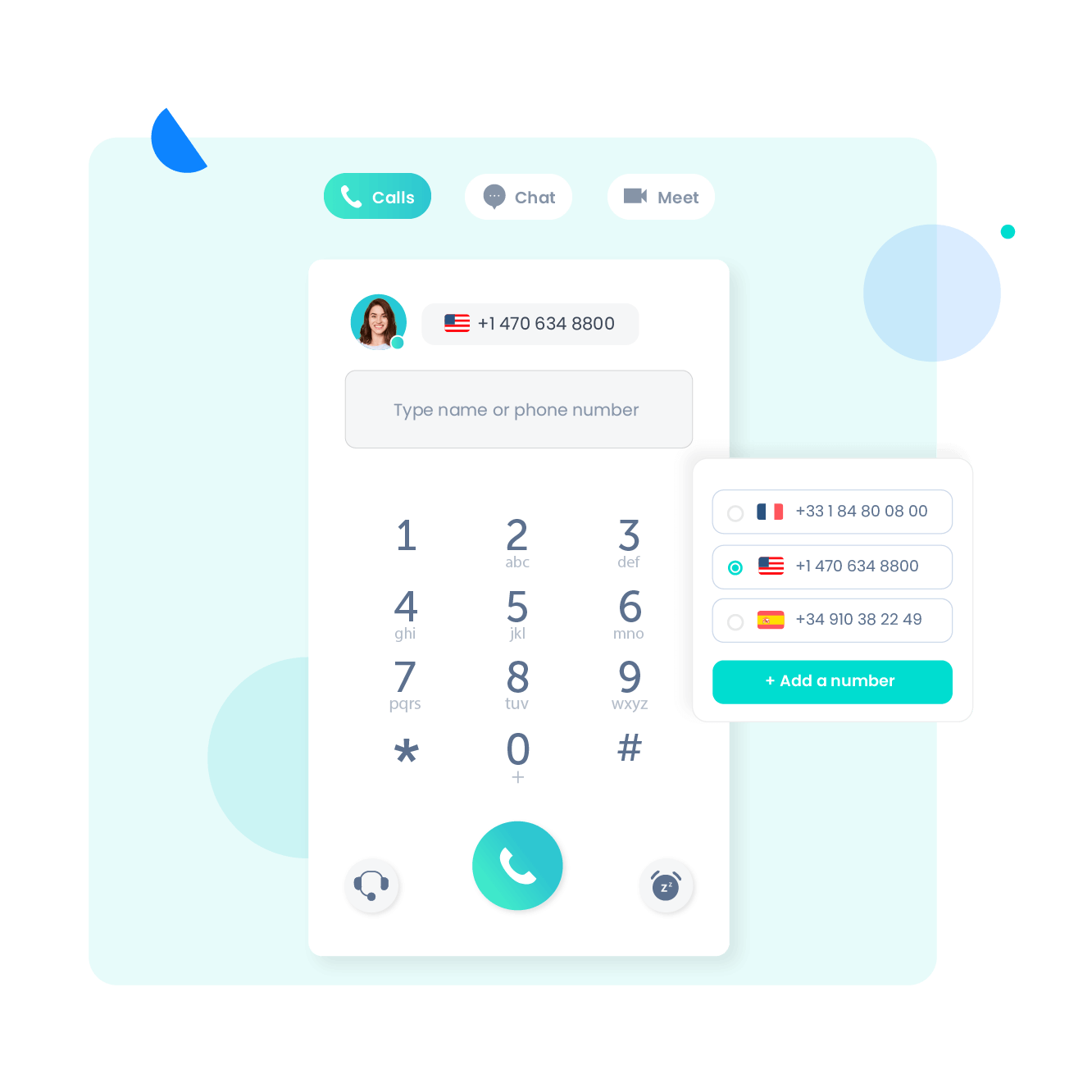

In the past, traditional call centers in the insurance industry required heavy and expensive infrastructure. This infrastructure included PBX systems, servers, monitoring equipment, VoIP phones, and had to be compatible with the company’s IT network. Fortunately, with the advent of the cloud and VoIP, it is no longer necessary to invest in such infrastructure. In fact, call center solutions are now hosted in the cloud. In other words, you don’t need any additional hardware (other than your computer or smartphone connected to the internet) to take advantage of them. In fact, solutions such as Ringover allow you to make and receive calls from your computer, and more. Such solutions go beyond simple telephony. To take advantage of it, there is no need to complicate your life, since a simple online registration is enough to obtain an account in the name of your company. Of course, you will then have to request one or more virtual numbers that you will assign to your different departments and employees.

How to optimize your insurance call center for better profits & lower costs?

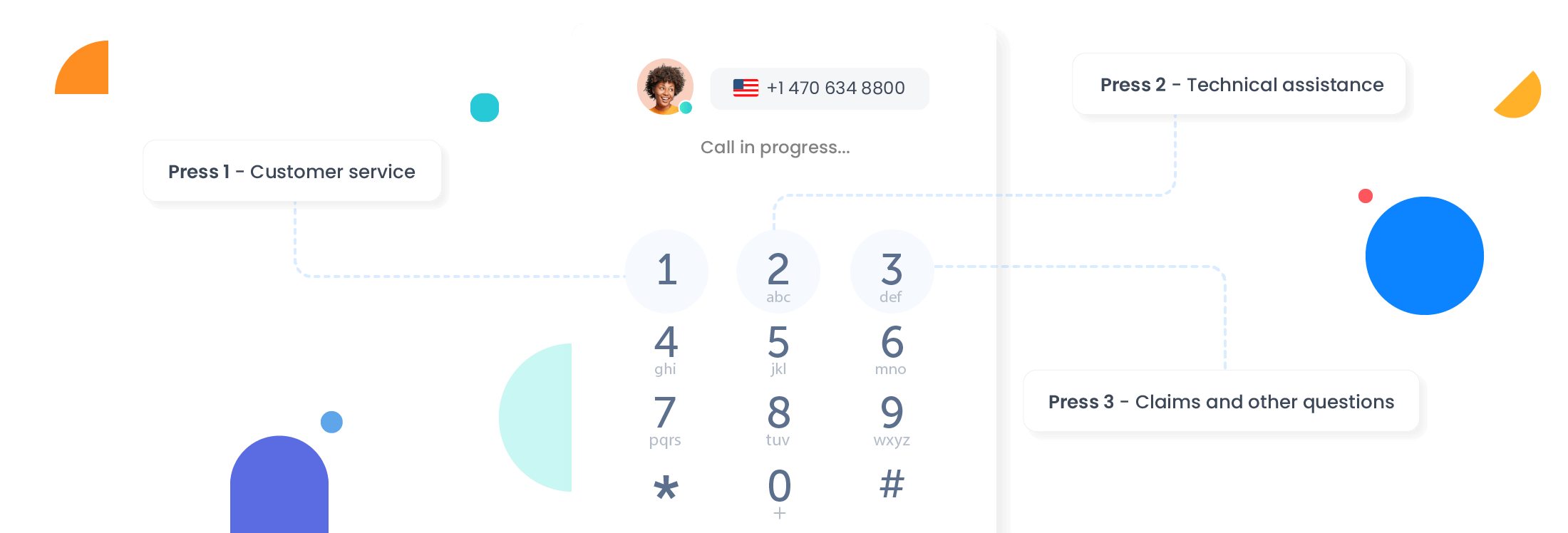

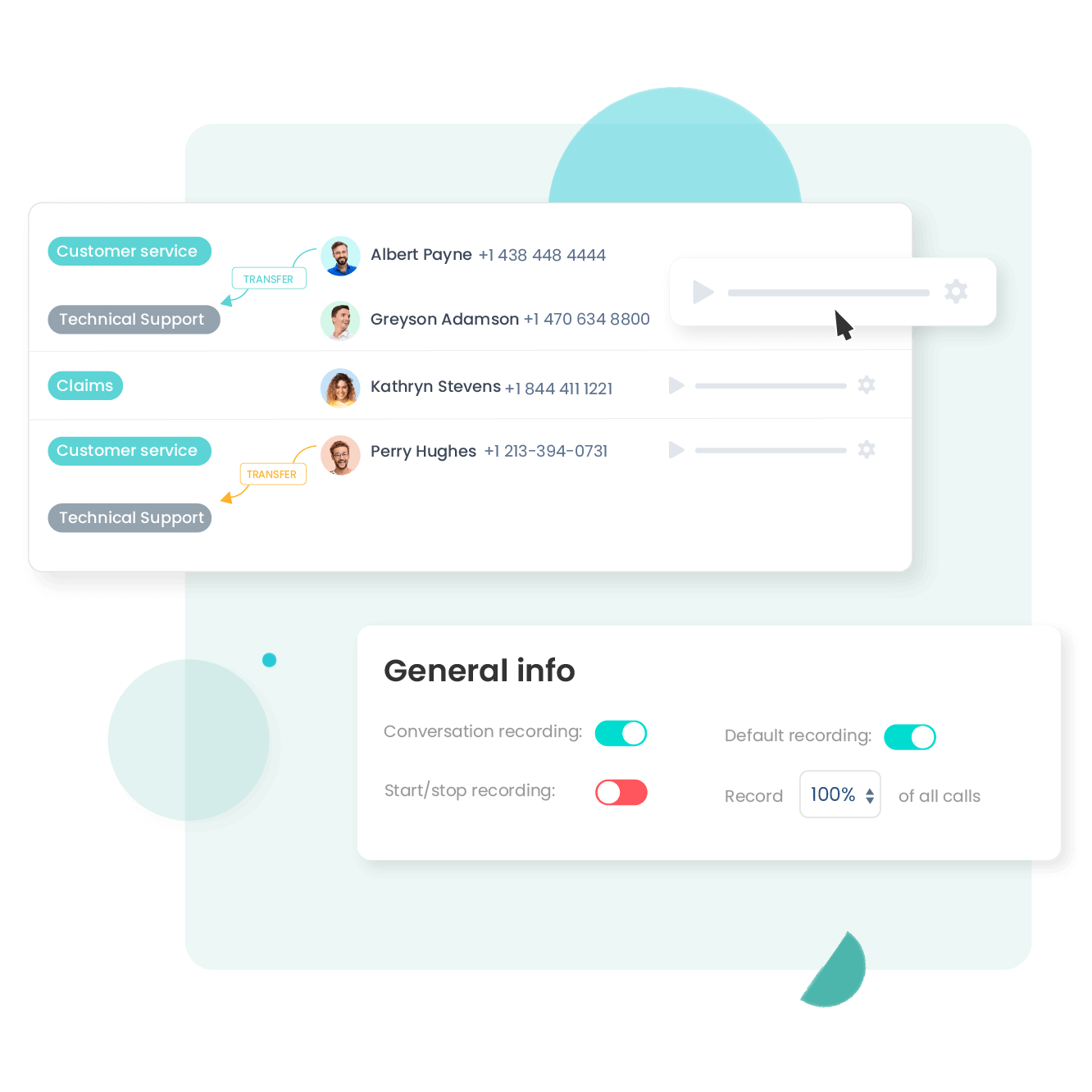

Process Automation

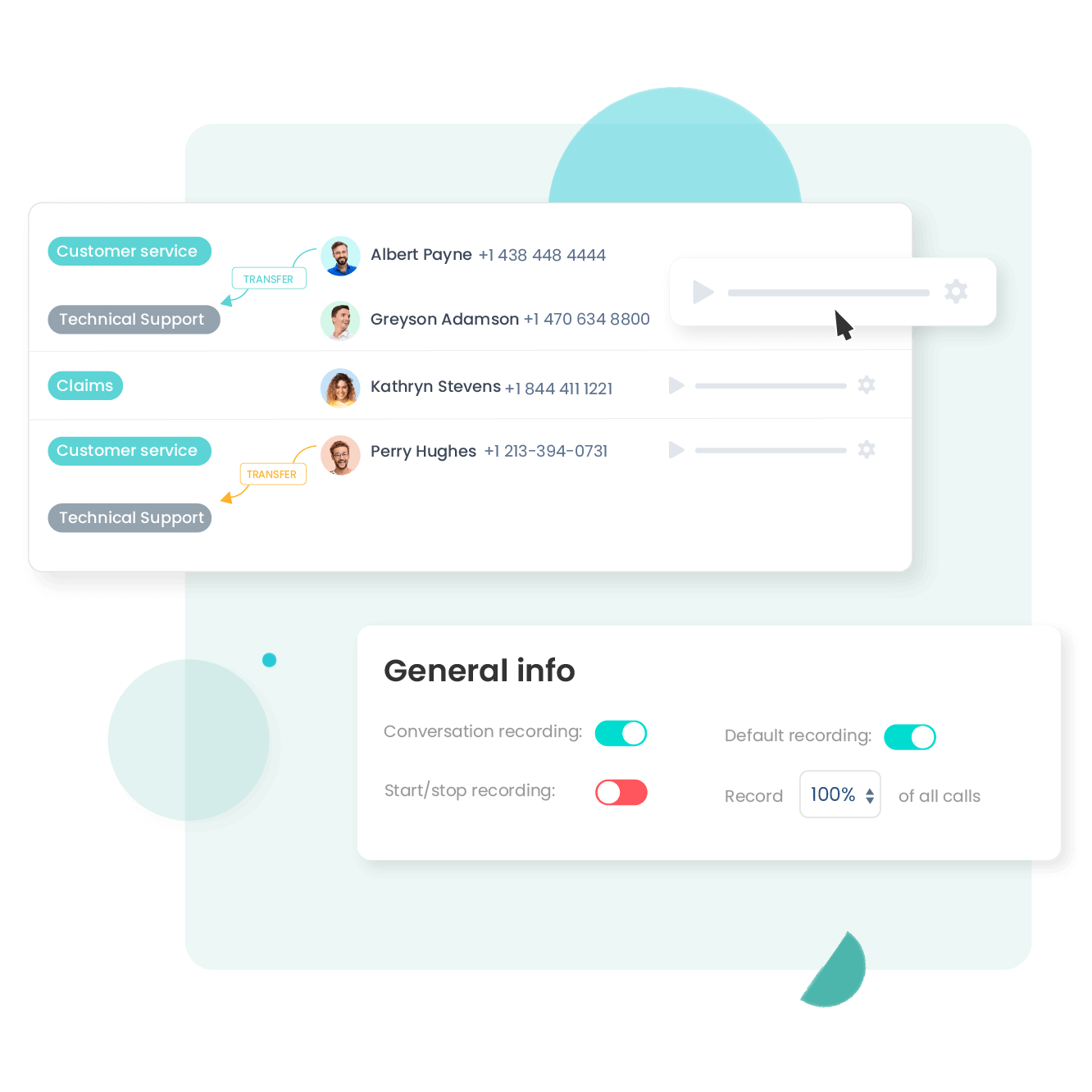

In the insurance industry, contact centers are faced with issues such as call volume, a wide variety of administrative tasks, and performing low-value tasks. With solutions such as Ringover, companies in the insurance industry can automate many of these processes. With interactive voice response, for example, users can themselves get the answer, service or person they want on the other end of the line. Intelligent routing features are included to facilitate and automate call routing. Finally, professionals can also take advantage of the call center software’s integrations with their business tools and deduplicate tasks such as annotations, importing call recordings, or updating records.

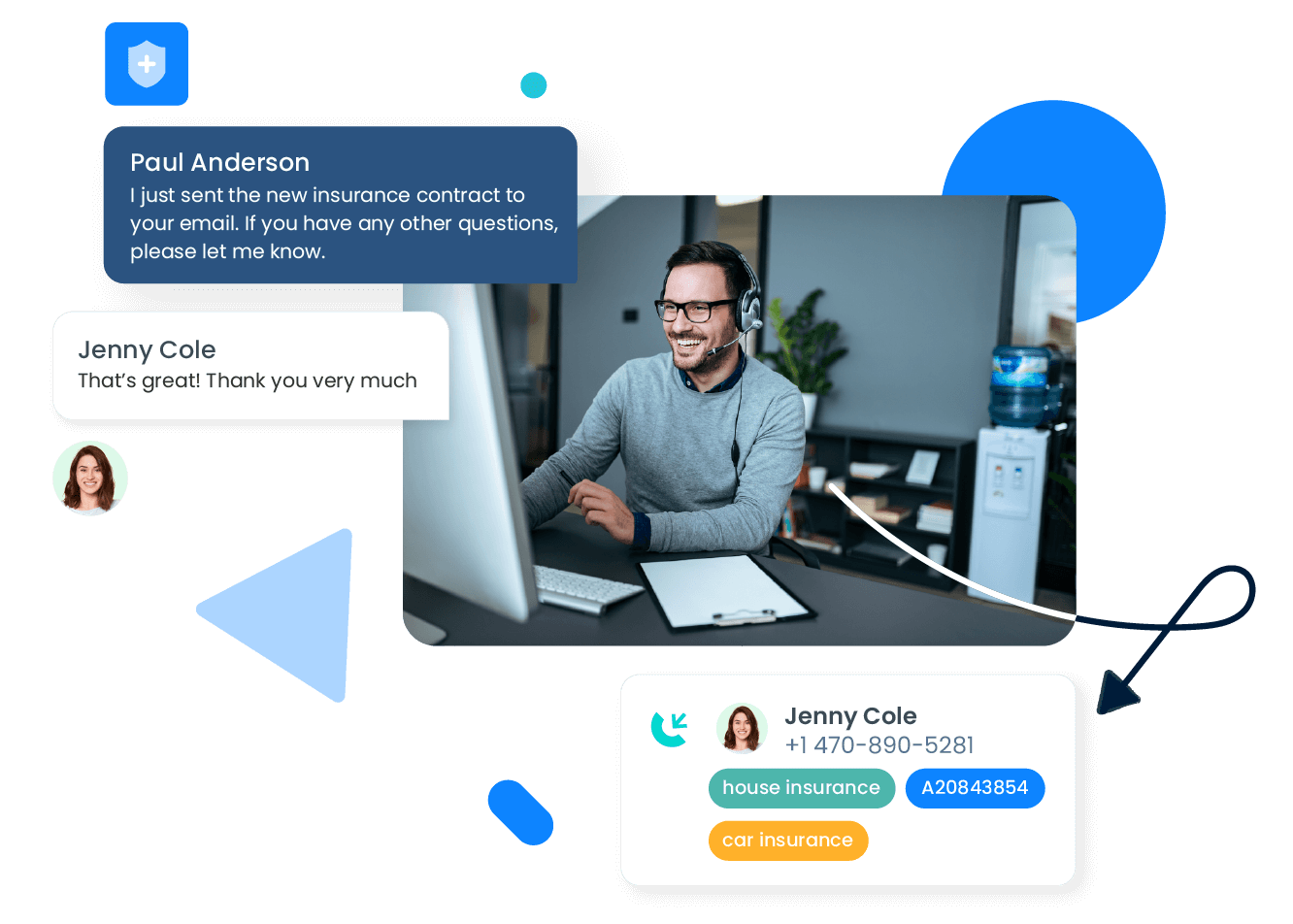

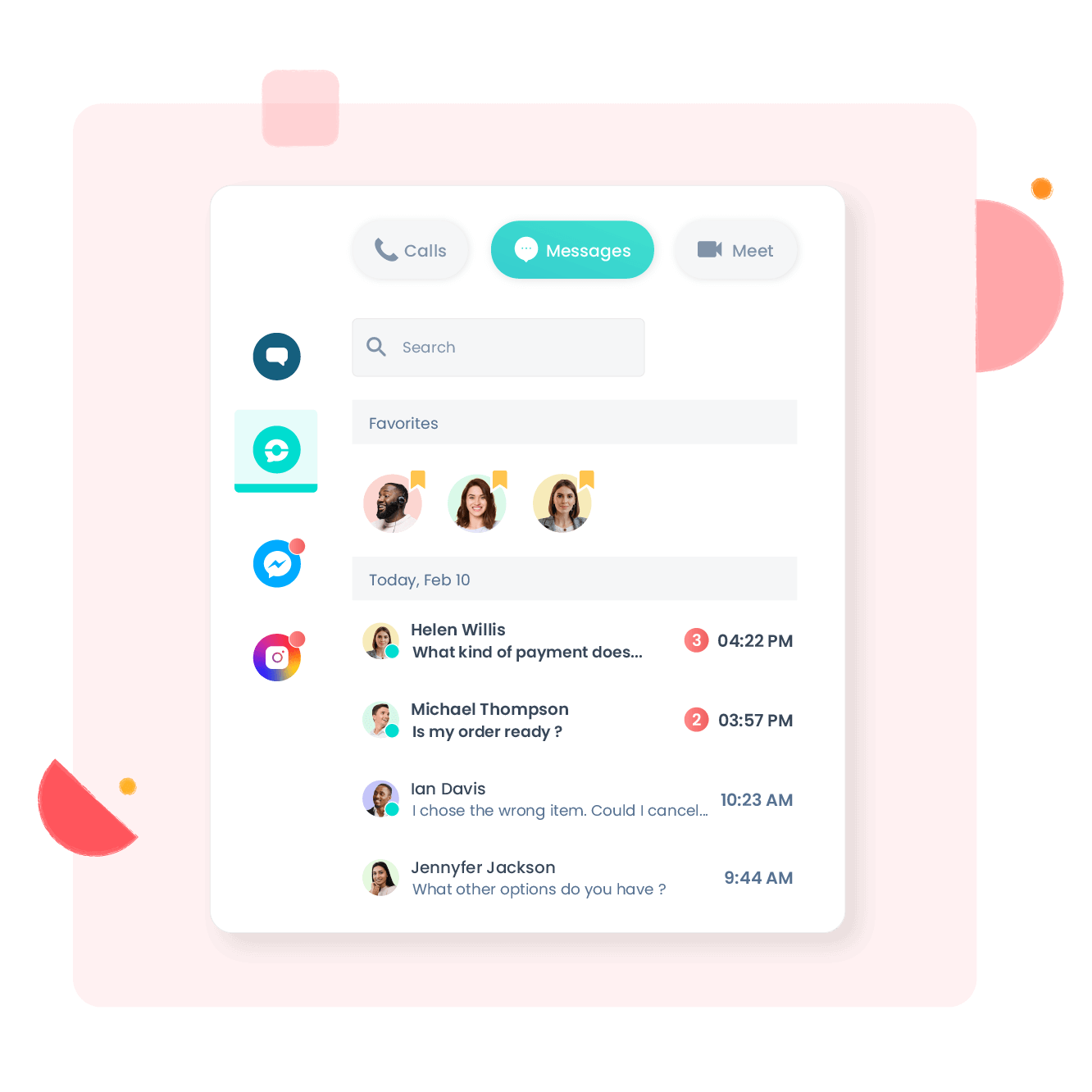

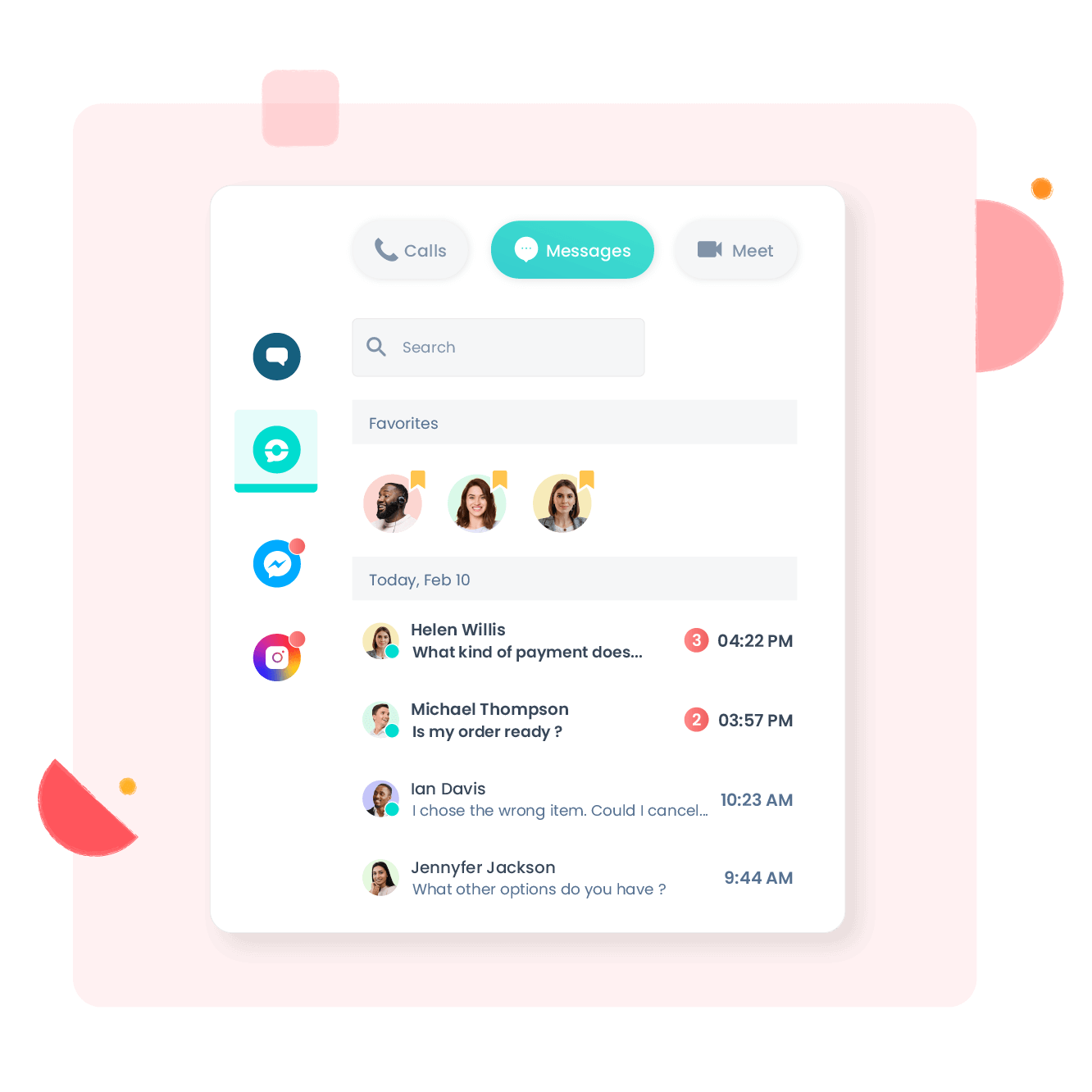

Omnichannel communication

Insurance companies can now centralize all of their communication channels into a single platform. Switching from a traditional call center to an omnichannel contact center can improve the experience while reducing costs. Offering multiple customer contact channels reduces the number of inbound calls and decreases the average wait time. In addition, professionals gain insight into all interactions with each customer, enabling them to provide ultra-personalized service and build customer loyalty.

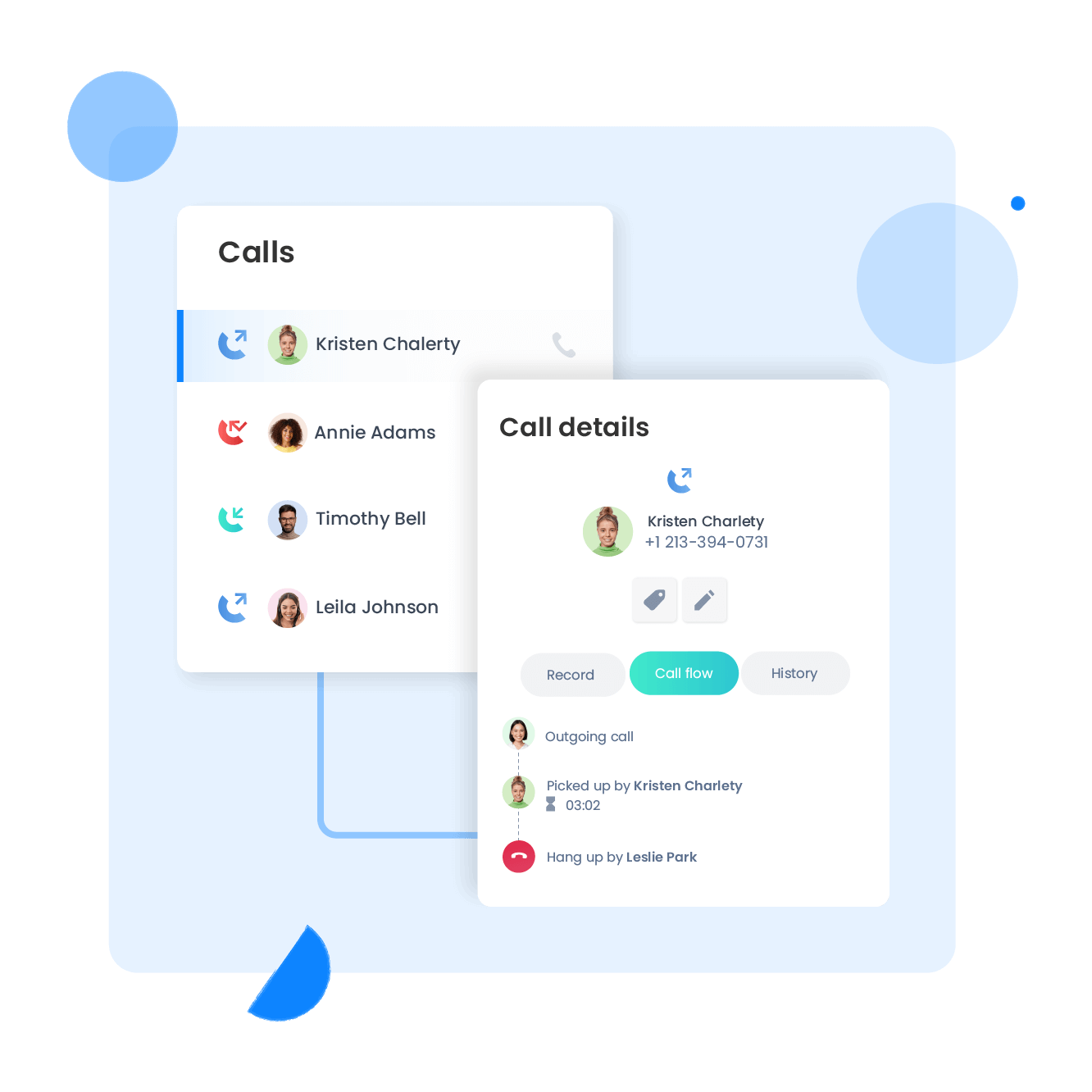

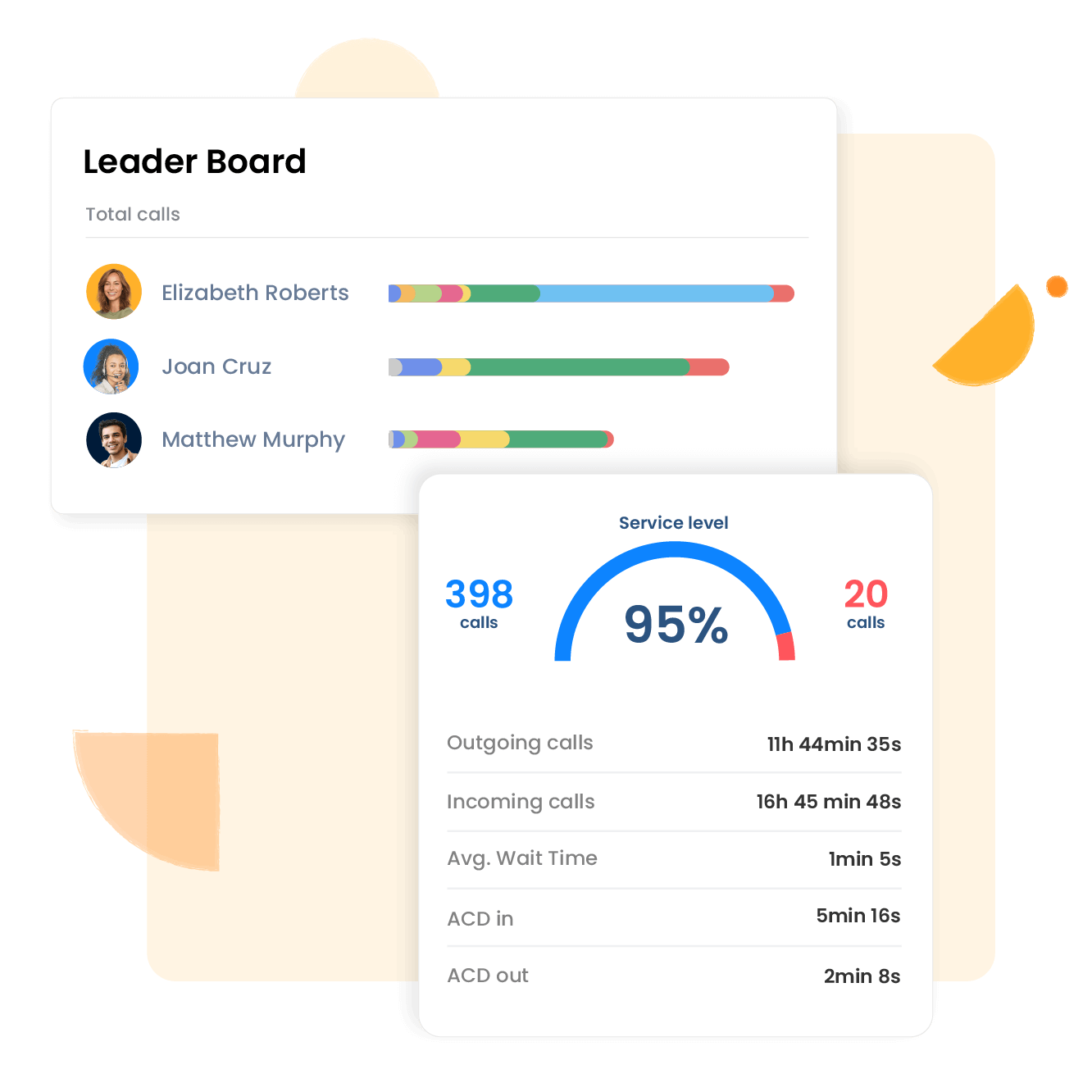

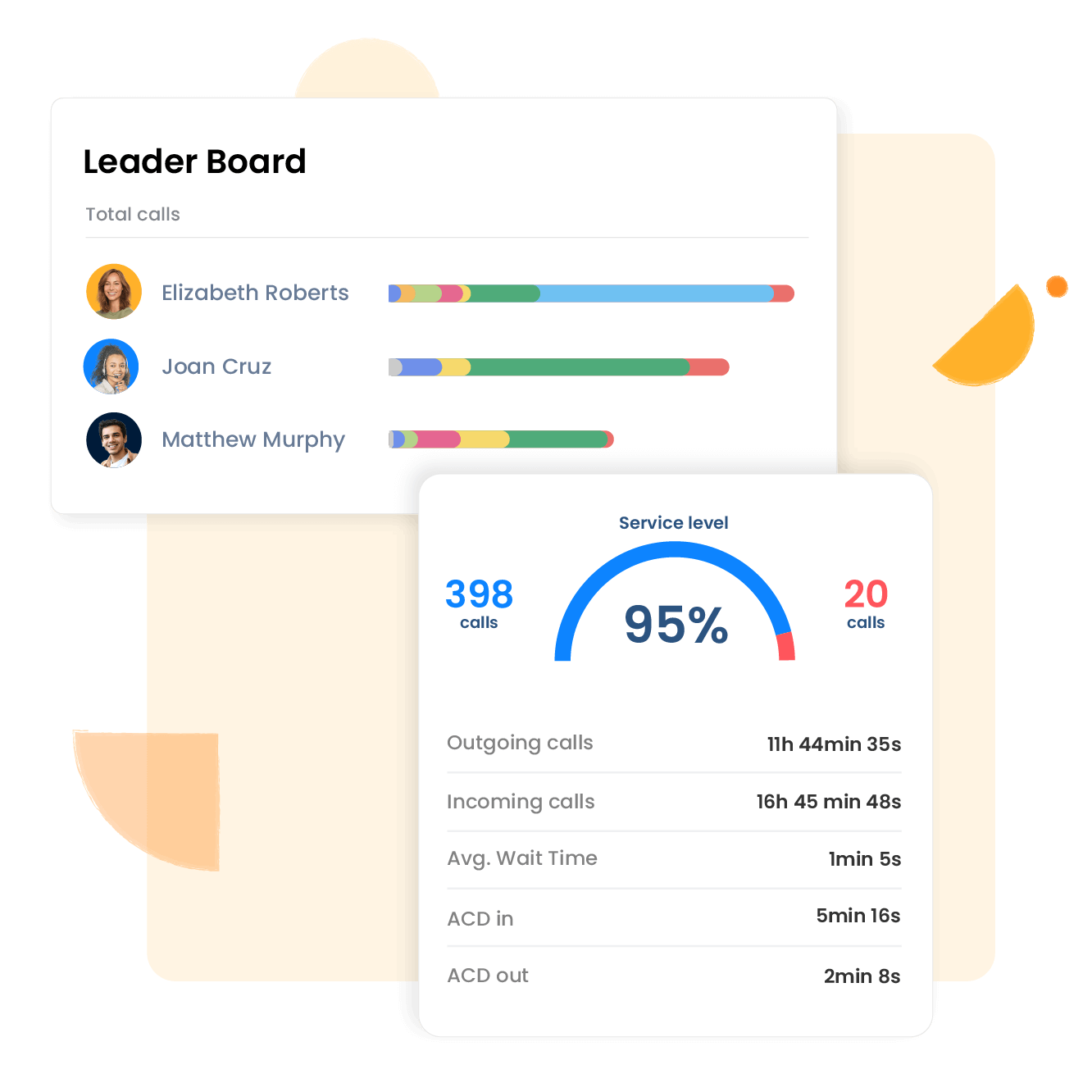

Data analysis and performance monitoring

Data analysis in a call center is essential, especially in a sector as competitive as insurance. Take advantage of tools to better monitor your metrics and KPIs to understand trends, organize your day-to-day operations and manage your business. To do this, Ringover integrates an intuitive and customizable dashboard that allows you to follow your statistics and rationalize everything to gain in productivity and efficiency.

How to set up your insurance call center correctly?

In the insurance sector, setting up an insurance call center now relies on the adoption of innovative technologies such as artificial intelligence and the cloud. Once you have decided on a solution, register and connect to the account provided by the insurance call center software supplier. At Ringover, the creation of an account and the first configurations are extremely simple and do not require any technical expertise in the field. You are guided step by step in your onboarding and can very easily request the portability of existing numbers to your new phone system. All that remains is to configure your first virtual switchboard by setting your own routing rules for incoming calls.

Why use Ringover’s call center for insurance?

Compare Ringover Contact Center features to other contact center platforms.

| Solution | Price | Features | Ease of Use |

|---|---|---|---|

| Ringover | |||

| Zendesk Talk | |||

| RingCentral | |||

| Freshdesk | |||

| Dialpad |

Other industries

Insurance Call Center FAQ

- What is an insurance call center?

- How long does Ringover take to deploy?

- Does Ringover offer out of the box integrations?

- What are the benefits of a call center solution for insurance companies?

What is an insurance call center?

In the insurance sector, the insurance call center has a privileged place:

- processing of claims;

- technical assistance;

- subscription to new contracts;

- management of renewals.

With the explosion of communication channels, the insurance call center must now be omnichannel in order to optimize the user’s experience, which is a determining factor in their retention.

How long does Ringover take to deploy?

Deploying a cloud solution such as Ringover within a structure such as an insurance call center is relatively simple compared to traditional solutions. Creating accounts and assigning numbers takes only a few minutes. You won’t have any problems with the installation on your employees’ workstations as it is a 100% cloud solution accessible from a standard web browser. Nevertheless, if you wish, you can download the application provided by the editor on the following systems:

- Linux

- Windows

- MacOS

- iOS

- Android

Ringover is compatible with existing hardware: headset, IP phone, computer.

Does Ringover offer out of the box integrations?

Yes, the omnichannel communication platform provided by Ringover is compatible with other solutions used by companies in this sector: Microsoft Teams for collaboration or CRM software such as Freshsales.

What are the benefits of a call center solution for insurance companies?

Insurance call center software plays a critical role in improving the quality of customer service. Properly configured and integrated with internal processes, it enables companies to provide fast and professional assistance to their increasingly demanding customers.

Such a platform facilitates the management of inbound and outbound calls and is essential for the efficient handling of claims, inquiries, claims assistance, and contract renewals. Ultimately, it is a good tool to reduce the average waiting time of the customer when contacting the company, but also to optimize the routing of calls and increase the efficiency of agents.